change in net working capital formula dcf

2016 prior period. Net Working Capital Formula.

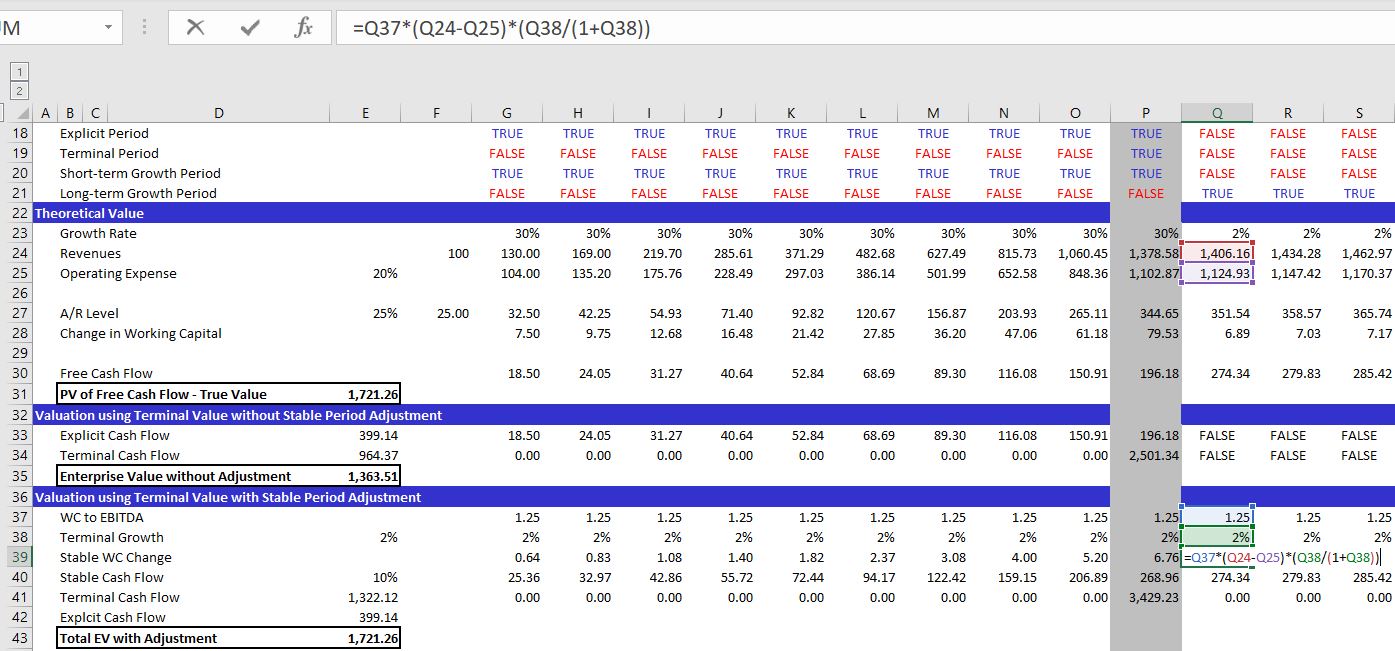

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

Change in Working capital does mean actual change in value year over year ie.

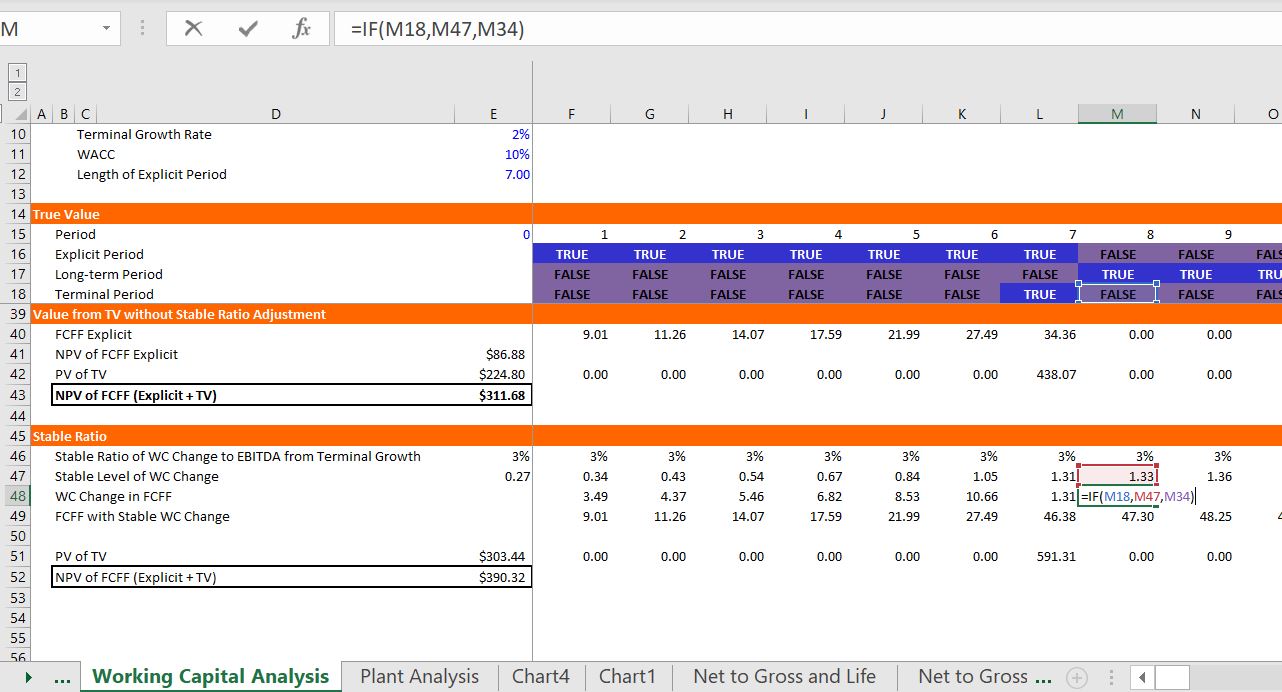

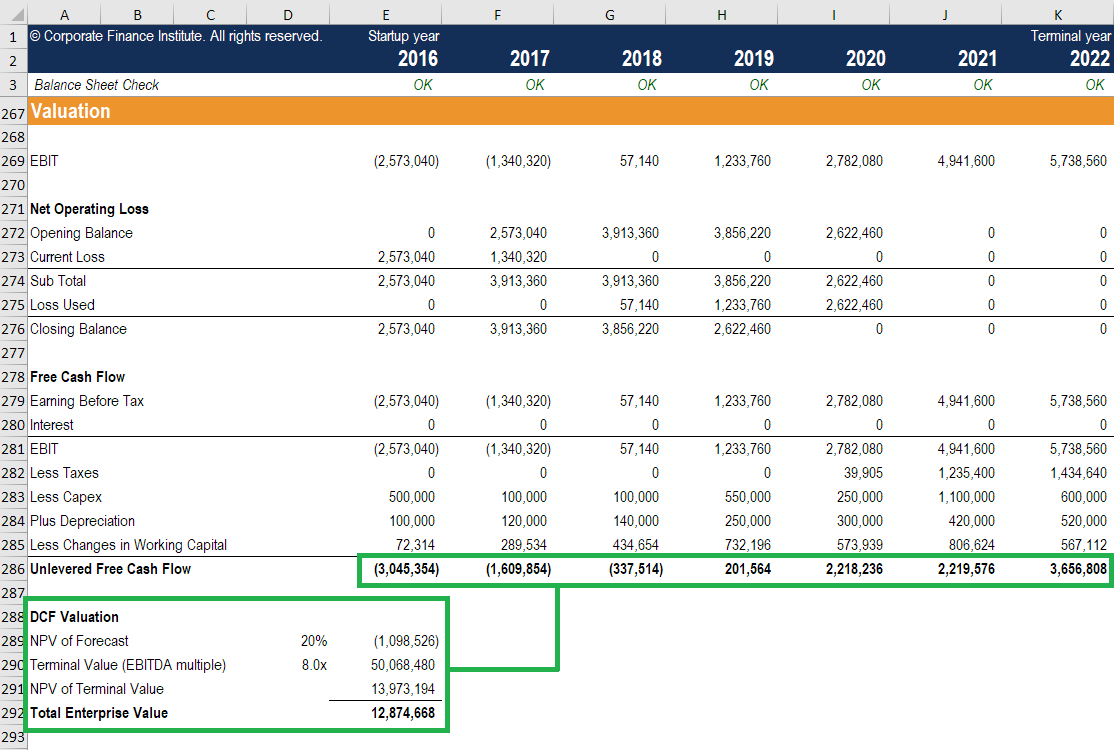

. FCFF 1WACC 1 for year 1 2 for year two and so on up to year 5. 2017 current period. The second file includes other working capital items and has a bit more detail In evaluating stable working capital both files demonstrate that you can use the following formula in the terminal period for stable working capital.

Change in Net Working Capital 12000 7000. The goal is to. Change in Net Working Capital NWC Prior Period NWC Current Period NWC.

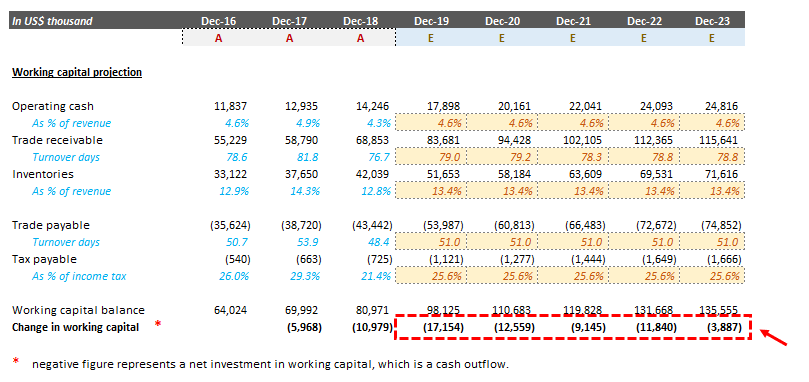

Working capital changes can make cash flows lumpy and simply putting last years or the trailing twelve month free cash flow number into a DCF model could produce wild swings. Net Working Capital Current Assets less cash Current Liabilities less debt or. It means the change in current assets minus the change in current liabilities.

Change in net working capital net working capital for current period net working capital for previous period Take a look at the table above again we can calculate the Change in Net Working Capital of the firm. Year 2 Working Capital 180m 190m 10m. Step 4 Capital Expenditures.

FCF EBIT1-Tax Rate Depreciation and Amortization Capital Expenditures Increases in Net Working Capital NWC If you have an increase in net working capital you have more current assets than liabilities than you did in the previous period. In Year 1 the working capital is equal to negative 5m whereas the working capital in Year 2 is negative 10 as shown by the equations below. Year 1 Working Capital 140m 145m 5m.

Change in Working Capital Summary. In Table 1010 we report on the non-cash working capital at the end of the previous year and the total revenues in each year. Stable WC Change WCEBITDA EBITDA t terminal growth1terminal growth.

An example of the first year is as follows. Add or subtract the amount. Net Working Capital Current Assets Current Liabilities.

AP accounts payable. The entire intuition behind CA-CL is to arrive at how cash has changed over the period increases in CA use of cash increase in CL source of cash--in that sense you would use non-cash CA - CL to get to FCF to do your DCF. Since the change in working capital is positive you add it back to Free Cash Flow.

PV 956 1 10341. Change in Net Working Capital Net Working Capital for Current Period Net Working Capital for Previous Period. Determine whether the cash flow will increase or decrease based on the needs of the business.

If youre asking whether you include cash in the CA to get to change in net working capital the answer is no. Thats why the formula is written as - change in working capital. If a transaction increases current assets and.

Thus the formula for changes in non-cash working capital is. PV 95607 110341. Calculate the change in working capital.

Working capital increases. If we calculate terminal value based on a year of high growth we are assuming the level of capital expenditure and working capital investment required to support the high growth will also remain at the same level perpetually which is definitely not the case when the growth rate drops to 3 at 93 growth changes in working capital is 118k. How do you project changes in net working capital NWC when building your DCF and calculating free cash flow.

Under ordinary operating conditions many if not most companies have positive working capital current assets exceed current liabilities so forecasted increases in revenues require additional working capital investments and free cash flow is reduced all else held constant. Free cash flow decreases. On the Cash Flow Statement the Change in Working Capital is defined as Old Working Capital New Working Capital where Working Capital Current Operational Assets Current Operational Liabilities.

Now that we have the free cash flow figured we could find the present value of those cash flows the formula for that process is below. Accounts Payable 100m 125m. As a sanity check you should confirm that if the NWC is growing year-over-year the change should be reflected as a negative cash outflow and the change would be positive cash inflow if the NWC is declining year-over-year.

Heres the formula for free cash flows Ill be referring to. Net change in Working Capital 1033 850 183 million cash outflow Analysis of the Changes in Net Working Capital. Accounts Payable 45m 65m.

Changes in working capital are reflected in a firms cash flow statement. InTable 1010 we report on the non-cash working capital at the end of theprevious year and the total revenues in each year. In this video I cover the different ratios tha.

Change in Net Working Capital is calculated using the formula given below. Change in Net Working Capital 5000. Its defined this way on the Cash Flow Statement because Working Capital is a Net Asset and when an Asset increases the company.

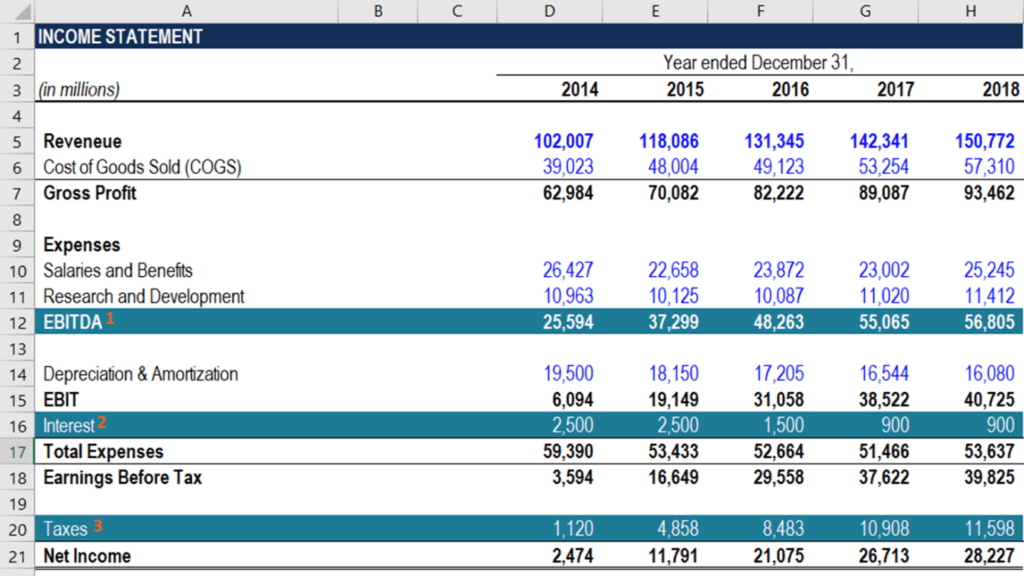

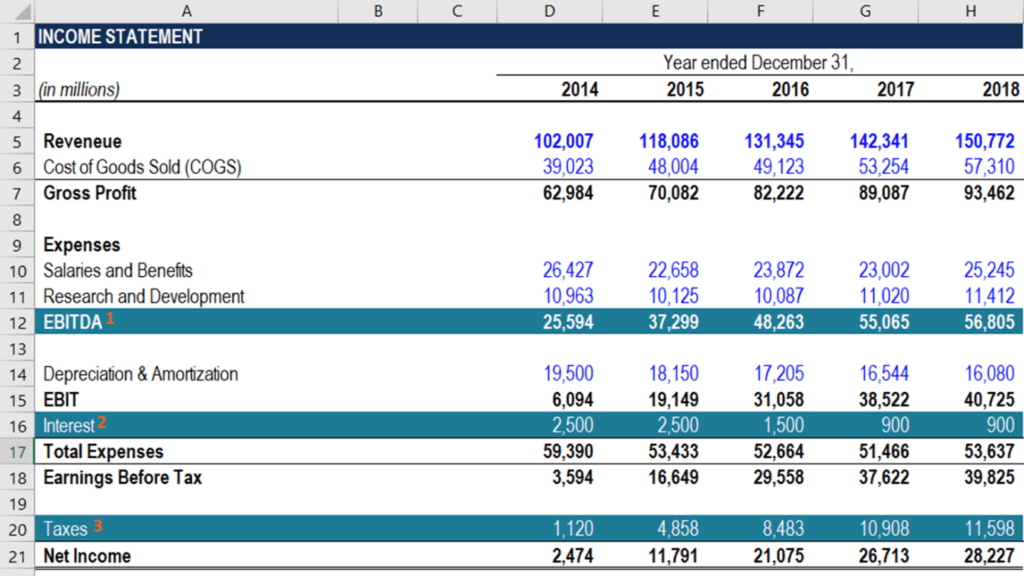

The formula for the change in net working capital NWC subtracts the current period NWC balance from the prior period NWC balance. The change in net working capital formula is given as N E B where E is ending net working capital and B is beginning NWC. Changes 2017 AR 2016 AR 2017 Inventory 2016 Inventory 2017 AP 2016 AP Where AR accounts receivable.

Non-cash working capital 1904 335 - 1067 - 702 470 million. Here are some examples of how cash and working capital can be impacted. The non-cash working capital for the Gap in January 2001 can be estimated.

There are a few different methods for calculating net working capital depending on what an analyst wants to include or exclude from the value. Working Capital The Gap.

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

Change In Net Working Capital Nwc Formula And Calculator

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

Projecting Net Working Capital For Free Cash Flow Calculation Dcf Model Insights Youtube

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

Change In Working Capital Video Tutorial W Excel Download

11 Of 14 Ch 10 Change In Net Working Capital Nwc Example Youtube

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Change In Net Working Capital Nwc Formula And Calculator

Dcf Model Tutorial With Free Excel Business Valuation Net

Dcf Model Tutorial With Free Excel Business Valuation Net

Dcf Model Training The Ultimate Free Guide To Dcf Models

Discounted Cash Flow Analysis Veristrat Llc What S Your Valuation

Net Working Capital Template Download Free Excel Template

Changes In Net Working Capital All You Need To Know

How To Calculate Fcfe From Ebitda Overview Formula Example

Change In Working Capital Video Tutorial W Excel Download